It is vital for organizations to have meetings regarding their expenses, cash flow, and other financial issues. This is where a treasurer report comes in and here is how users can make one for the next meeting with the treasury.

Treasurer Report Informs" />

Treasurer Report Informs" />

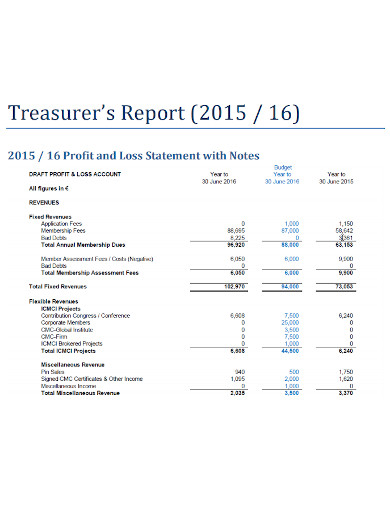

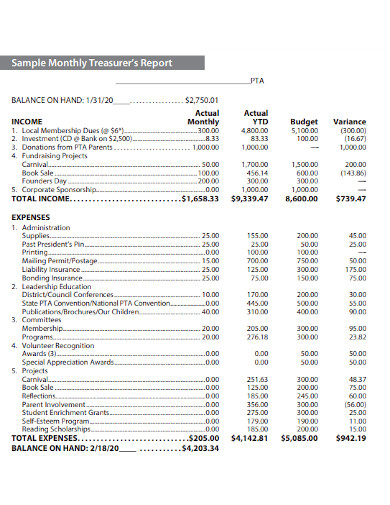

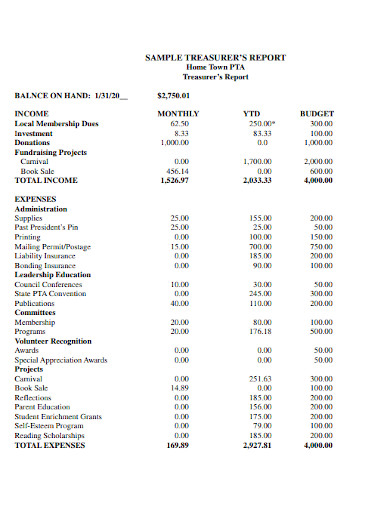

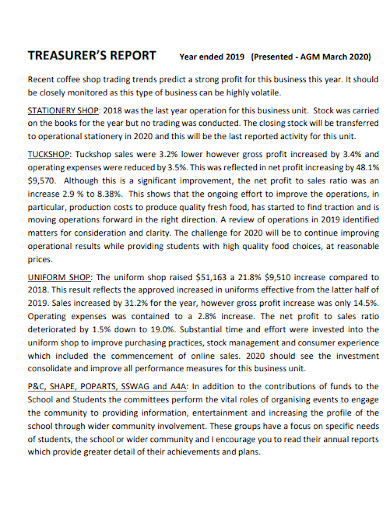

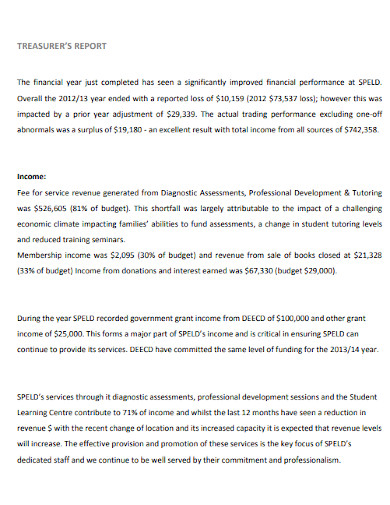

A treasurer report is a report made by a treasurer (or their assistant) detailing the expenses made by the organization along with what is left on their budget. The treasurer report is in a way, a more detailed version of a balance sheet.

A treasurer’s report needs to be as transparent as possible with the details. Here are five steps on how to make the report while staying both coherent and consistent.

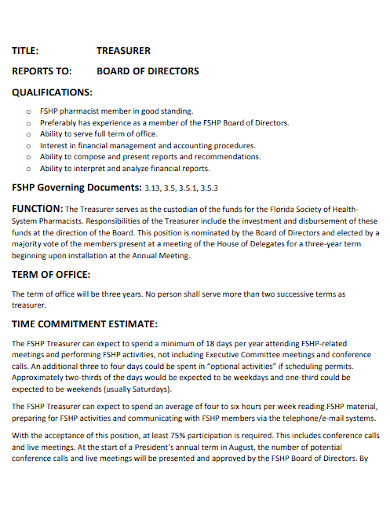

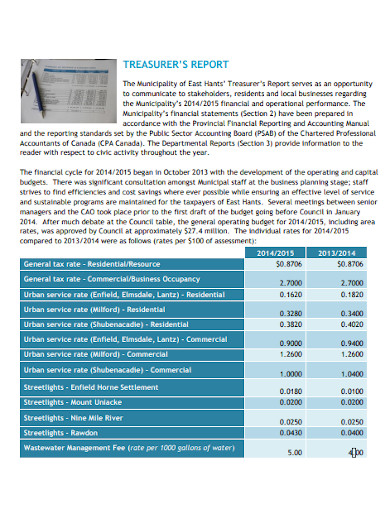

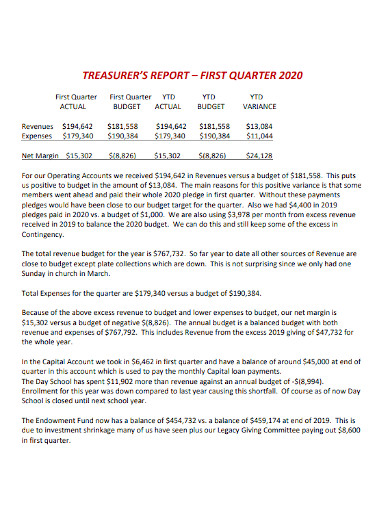

Whether you are a club, a church, or a nonprofit organization, you have to be specific on what type of organization you are and what you do, so that your expenses can make sense in the treasurer report. This is also to ensure that the facts are all consistent in case third-party organizations like law enforcement will be taking a look at your treasurer’s report.

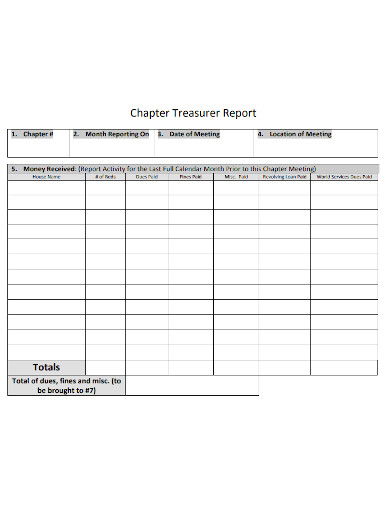

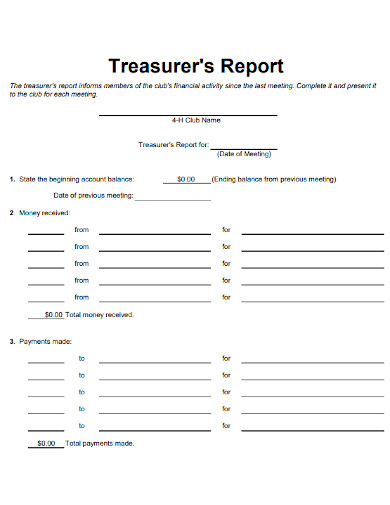

Be specific on the period of time that your organization spent money. That way there is a clear reference of how long the budget has been tapped on. You can use timeframes like a week, month, or quarterly (90-day period).

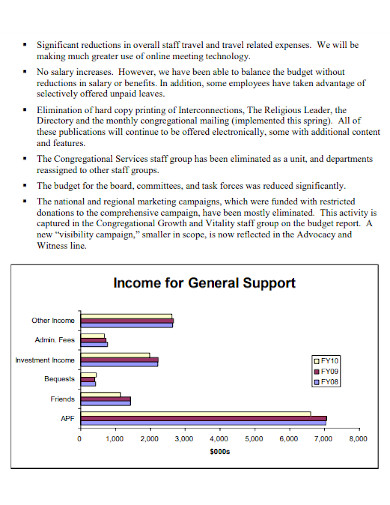

This is the meat of the report. The expenses of your organization must be listed down, not just the numbers, but the names of the items, and the reasons they were bought. You can also list other details as well such as income statements if your organization is involved in making profits.

One of the many points of making a treasurer report is to find out what remains of the initial budget given. That is why it is important to add both the starting budget and the ending budget that the organization has left so that readers will be able to detect any inconsistencies if there ever are one.

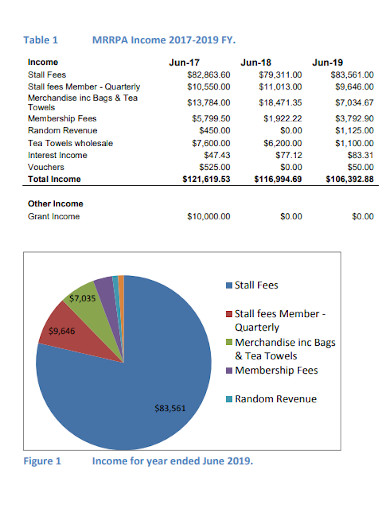

Make your treasury report coherent by organizing all the details. You can use a table or a list to present all the expenses that were made on the organization’s budget, that way management can easily understand the number being presented on the treasurer’s report.

A treasury refers to funds for an organization particularly those from corporations, institutions, or the government, which they can use to further their goals.

A treasurer refers to a person who is in charge of an organization’s treasury, it is their responsibility to oversee the funds and make sure it remains consistent with the organization’s expenses.

A treasury report allows an organization to take account of their budget, regarding how much they have spent, gained, and are left with as well as avoid any potential fraudulent activities being done with their funds.

Keeping track of the organization’s treasury prevents any fraudulent activities like embezzlement from happening undetected. Remember to remain honest and sharp when calculating the money of an organization, so you can create a reliable as well as productive treasurer report. Check out other templates like bank statements if you want to use other references for your report.